Strategies

STRATEGIES

Multistrategy:

Absolute Return

We focus on seeking asymmetric returns both upward and downward. Multistrategy involves combining multiple investment styles to function in all circumstances, even when other strategies fail.

HEDGE FUND

Fibonacci Fund

Our unique multi-strategy approach utilizes a combination of global macro investing and systematic trading strategies.

The fund’s investment objective is to achieve above-average capital growth (+20% p.a.) with an annual volatility of less than 10%. The fund focuses on absolute returns by investing in the most liquid underlying assets (up to 40%) hedged with derivative contracts (up to 60%).

average annual return*

worst month*

cumulative return*

*as of 10.8.2023

IV

DISCRETE MODEL

I

MACRO MODEL

II

SYSTEMATIC MODEL

III

ALLOCATION MODEL

V

RISK MANAGEMENT

MODEL

The Difference Between Traditional & Alternative Strategy

TRADITIONAL STRATEGIES

A

Most investors have 3 to 4 asset classes such as bonds, stocks, real estate, precious metals, or cash. Traditional diversification doesn’t work, as recent fluctuations have shown.

B

Traditional portfolios don’t benefit from diversification, as they tend to move in the same direction during adverse fluctuations.

C

Simply holding multiple ‘diversified’ investments belonging to the same asset class does not reduce volatility or risk – on the contrary, during turbulent times, it quickly increases and compounds losses.

MULTISTRATEGY

A

Exceptional level of diversification and low correlation.

B

True diversification = combination of multiple investment styles.

C

Focus on seeking returns both upward and downward.

D

Alternative strategies = principle of absolute return. Multistrategy operates in times when others fail.

PRIVATE EQUITY

Da Vinci Fund

The private equity fund invests in real assets to deliver returns and added value in any cycle.

The Da Vinci Fund utilizes an opportunistic investment approach through private equity. We focus on companies in healthcare, as well as the distribution and information technology sectors with a focus on pharmacy.

Our goal is to target companies in the defensive sector with above-average growth potential and the courage to change the world.

The strategy for developing acquired companies is based on partnership and close collaboration with management, active management, support for innovation, and providing our expertise and capital structure.

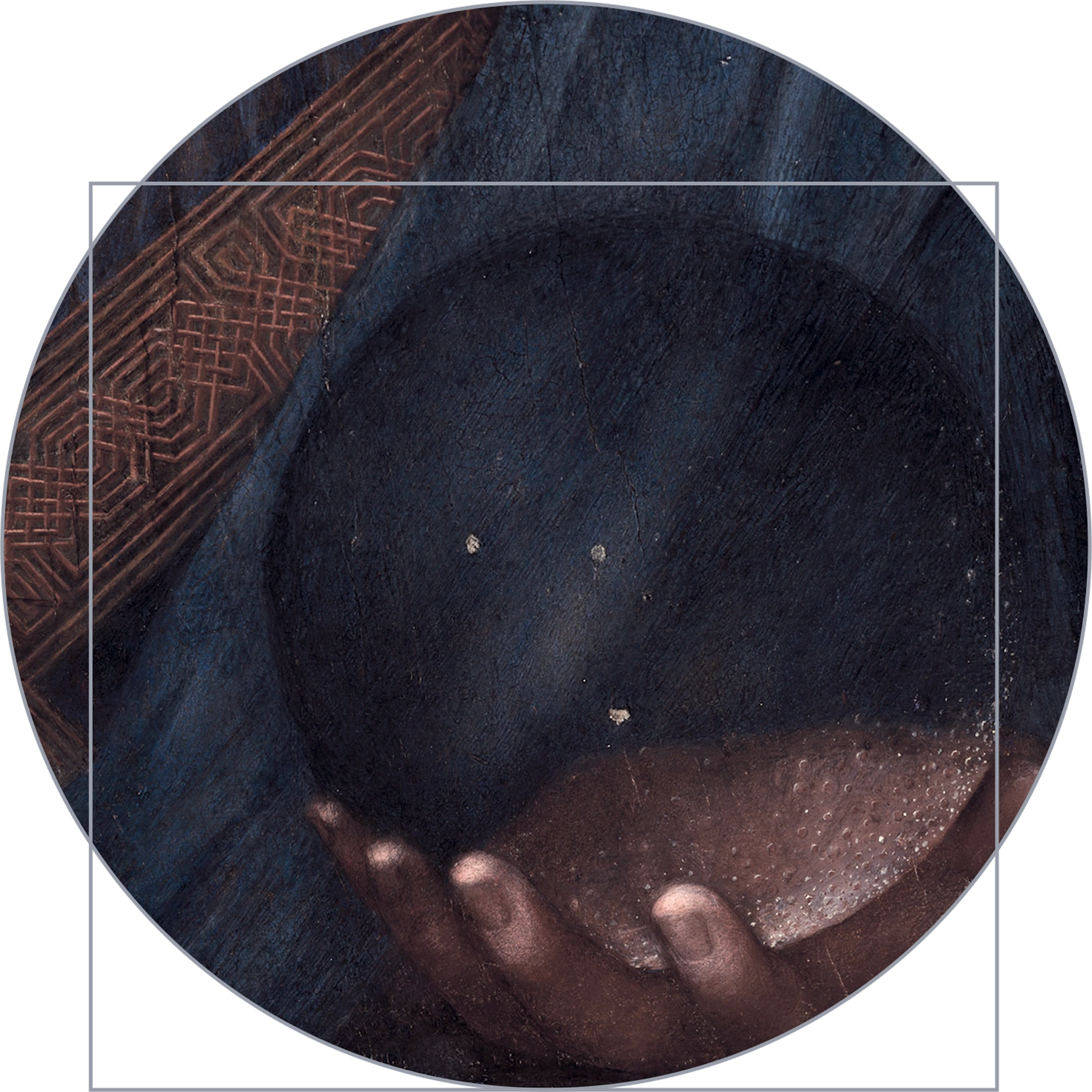

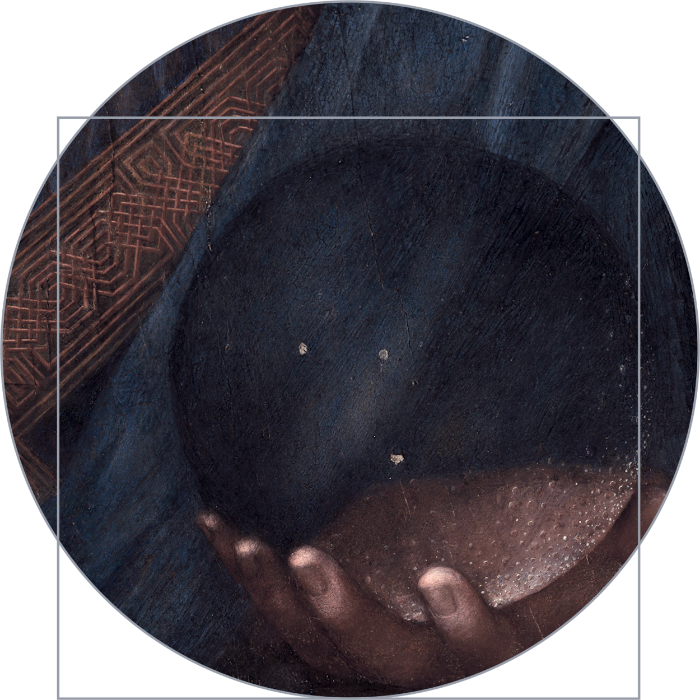

Salvator Mundi, Leonardo da Vinci, c. 1499–1510, detail

the fund’s target return

average annual return*

return since the fund’s inception

*as of 10.8.2023

Sectors

HEALTHCARE SECTOR

- pharmaceutical manufacturing

- distribution

- specialised products and services

- healthcare technologies and innovations

Geographical Focus

- CEE countries

- South Eastern Europe

- emerging markets in Asia

- South America

Salvator Mundi, Leonardo da Vinci, c. 1499–1510, detail

The Advantages

of Real Asset Funds

GLOBAL MACRO

Singapore VCC

Stonebridge Capital VCC is an opportunistic global macro fund.

Our advantage lies in agility and focus on isolating persistent market anomalies identified in academic literature, as well as those discovered by industry experts, enabling us to capture alpha throughout market cycles.

The fund’s investment objective is to generate absolute returns in the medium to long term horizon, with minimal correlation to systematic risk factors. Strategies are based on our investment themes, from which we generate scenarios of future events.

AAA

rating

5

funds

19

years of experience

Insider

We rely on our proprietary in-depth research, which is systematic. We thoroughly analyze emerging risks and opportunities.